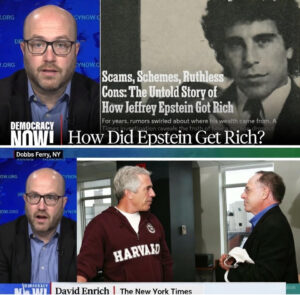

A college dropout who never finished university rockets from teaching math at an elite prep school to managing billions for America’s richest men—amassing a $600 million fortune, private jets, and islands that fueled his dark empire.

But a bombshell New York Times investigation shatters the myth: Jeffrey Epstein built his wealth not through genius investing, but through ruthless scams, outright theft, lies, and exploiting ultra-wealthy clients like Victoria’s Secret billionaire Les Wexner, who handed him total control over his finances.

From faking credentials at Bear Stearns to misappropriating millions and dodging taxes in the Virgin Islands, the truth exposes a con man shielded by power.

With the full Epstein files mandated for release tomorrow, survivors hope for justice.

How deep did the deceptions go—and what other fortunes were quietly drained?

Jeffrey Epstein’s meteoric rise from humble Brooklyn roots to unimaginable wealth has long baffled observers, but a December 16, 2025, New York Times Magazine investigation—drawing on unpublished interviews, archives, and thousands of records—reveals a trail of deception, theft, and exploitation. Born in 1953 to a working-class family in Coney Island, Epstein skipped college graduation yet landed a teaching job at Manhattan’s prestigious Dalton School in 1974. There, a student’s parent invited him to an art gallery event, leading to an introduction with Bear Stearns executive Ace Greenberg. Impressed by Epstein’s purported math prowess, Greenberg hired him in 1976 despite no finance experience.

At Bear Stearns, Epstein quickly ascended to limited partner by 1980, but his tenure ended abruptly in 1981 amid flagrant violations: falsely claiming a college degree, abusing expense accounts, and granting a girlfriend privileged investment access—offenses detailed for the first time in the Times report. Former colleagues described him as a charismatic salesman who bent rules, yet he escaped severe consequences, leveraging connections to pivot into private money management.

The pivotal breakthrough came in the 1980s when Epstein charmed Ohio retail tycoon Leslie Wexner, founder of L Brands (Victoria’s Secret, The Limited). Despite warnings from advisors like financial manager Harold Levin—who reportedly said, “I smell a rat”—Wexner granted Epstein sweeping power of attorney in 1991. Epstein managed Wexner’s vast fortune, signing tax returns, handling acquisitions, and even living in properties Wexner owned. Over decades, Epstein siphoned tens of millions—some estimates reach hundreds—through opaque fees, transfers, and asset shifts, acquiring his own Manhattan mansion (transferred for $1), private Boeing 727 (originally L Brands’), and Caribbean islands.

Epstein’s firm, J. Epstein & Co. (later Financial Trust Co.), claimed to serve only billionaires, but records show primary revenue stemmed from Wexner and later clients like Apollo Global’s Leon Black, who paid millions for tax advice. Offshore entities in the U.S. Virgin Islands exploited tax breaks, fraudulently obtained per later settlements. Investments, like $40 million in Peter Thiel’s Valar Ventures yielding massive returns for his estate, supplemented but didn’t originate the wealth.

This fortune enabled Epstein’s trafficking network, insulating him via elite ties—presidents, princes, CEOs—while banks like JPMorgan ignored red flags for years. Victims endured horrors funded by these deceptions; survivors like those in civil suits highlight how wealth bought silence.

Tomorrow’s December 19 release under the Epstein Files Transparency Act—flight logs, financials, depositions, forensics—promises deeper insights. Will it confirm misappropriations, name enablers, or expose more drained fortunes? In an age questioning elite accountability, the probe evokes empathy for victims, surprise at systemic failures, and urgent curiosity: How many lives—and legacies—were tainted by one man’s cons?

Leave a Reply